Maple Finance: Institutional Crypto-Capital Network

2022-08-02 • Kaleb Rasmussen, Ronith Yalamanchili

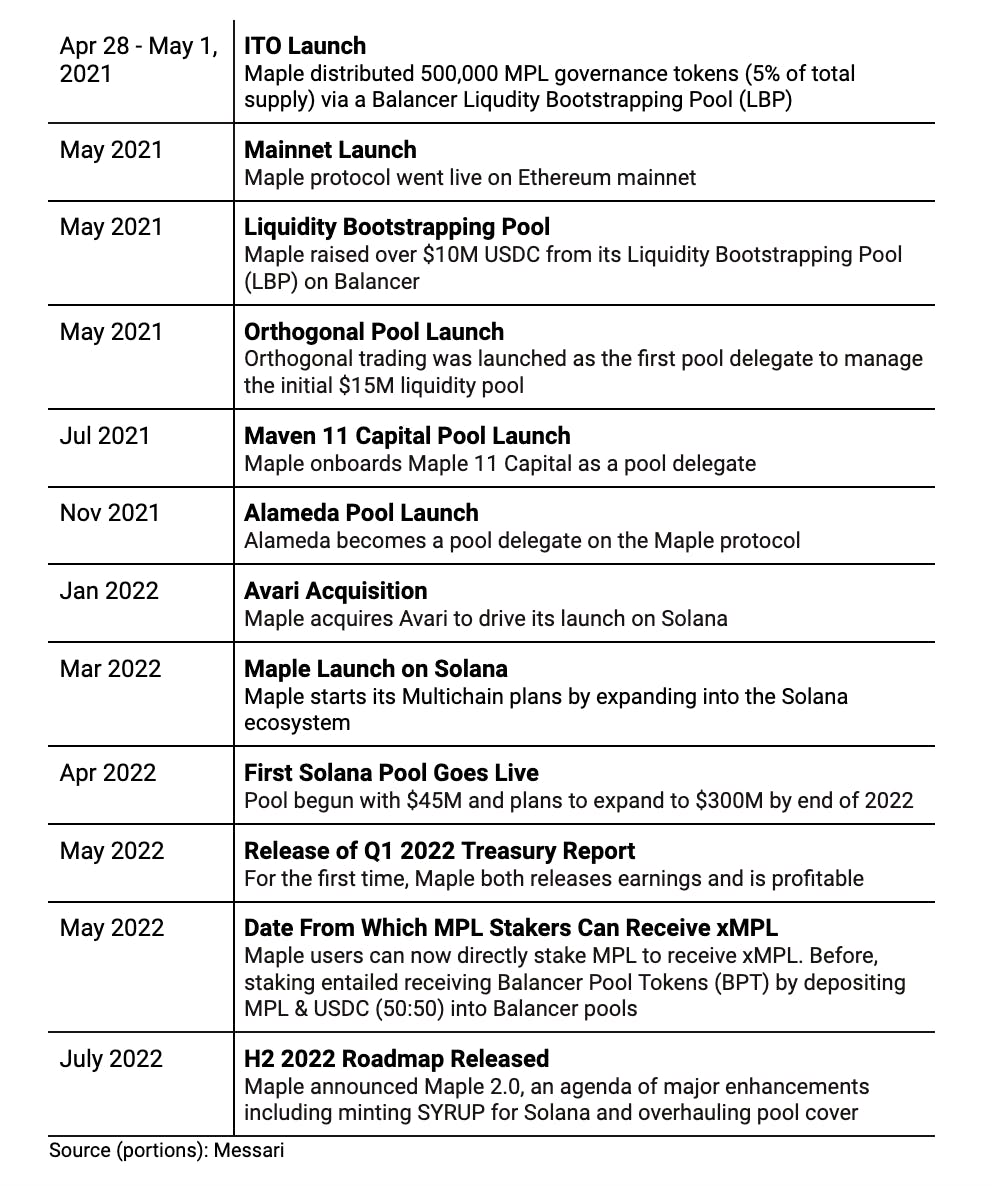

GM everyone! Today, we’re going to explore Maple Finance, a DeFi protocol on Ethereum and Solana building the infrastructure needed to expand institutional lending on-chain. Since launching on Ethereum’s mainnet on May 12, 2021, it has issued over $1.5 billion in loans and has expanded to Solana.

Maple’s unique solution offers secure and transparent yield for lenders, as well as fixed terms (rate, duration, collateral) and flexibility (no auto liquidation) for borrowers. We’ll be exploring Maple’s solution and governance token (MPL), main competitors, and what their future may look like.

Main Value Proposition

Prior to Maple Finance, lending and borrowing on DeFi was mainly used to free up capital and leverage positions. However, protocols like Maple are bringing more use cases to DeFi and broader capital markets. They are building the infrastructure that will allow for institutional lending and borrowing to occur on-chain and provide financing for real-world projects such as real estate development and business expansion.

In terms of market cap and total value-locked, overcollateralized protocols such as AAVE (over $9.6B in TVL) and Compound (over $3.7B in TVL) are currently leading this space. They’ve proven their resiliency during difficult market conditions but their overcollateralized models are capital inefficient and not as typical as traditional financial institutions. Unlike the original DeFi lending protocols, Maple offers institutions the ability to take out undercollateralized loans and brings lending books on-chain. This raises transparency in the overall market as transactions, important data points, and reserves are made visible through open-source smart contracts. Furthermore, while centralized lenders such as Celsius and BlockFi have halted withdrawals during turmoil, properly audited smart contracts ensure that positions can not be frozen. Together these attributes position blockchain & DeFi lending to compete meaningfully with traditional finance.

How It Works

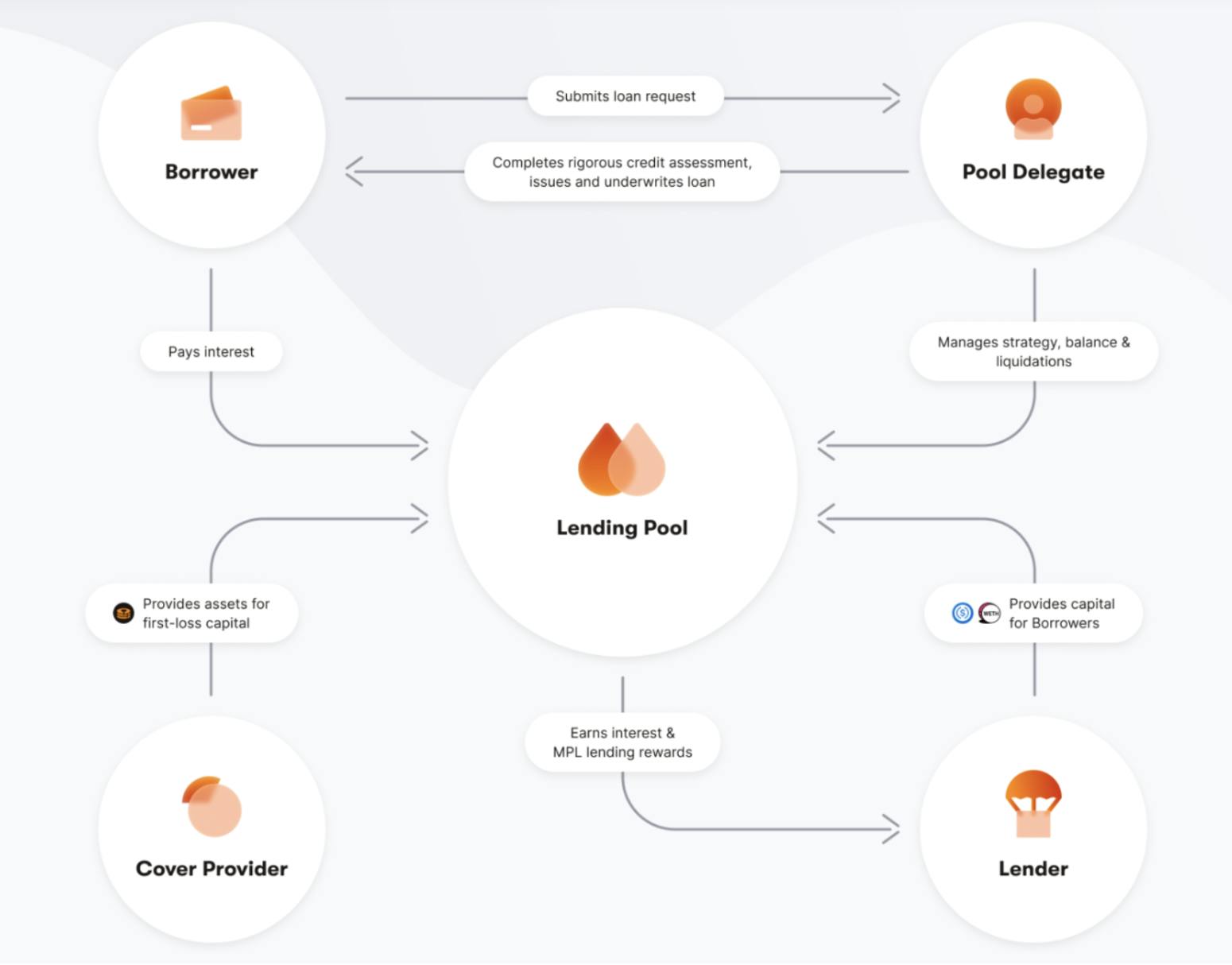

Maple uses four different participants in order to distribute capital: Pool Delegates, Lenders, Cover Providers, and Institutional Borrowers. Lenders and Cover Providers provide capital in lending pools hosted by approved pool delegates. Lenders act as the senior tranche (last to be liquidated in a default event) and Cover Providers act as the junior tranche (first to be liquidated in a default event) of the loan. Pool delegates conduct due diligence and underwrite the loans for borrowers off-chain, who pay interest back to the pool. This mechanism allows approved institutional borrowers to have access to large loans in a transparent manner.

Pool Delegates

Maple’s protocol introduces pool delegates as a third party to facilitate the lending process. Pool delegates conduct rigorous off-chain KYC-AML due diligence and negotiate terms with the borrower. By leveraging their strong and predictable cash flows and creditworthiness, large institutions can scale their businesses in a more capital-efficient manner as they do not need to overcollateralize their loans. The ‘first-loss capital’ the delegates must provide will be the first to be liquidated in the event of a default, and it constitutes a portion of the pool’s cover. This helps to align their interests with lenders and other cover providers to take appropriate risk. Delegates must first be whitelisted by the Maple DAO in order to create a pool. XMargin was the first pool delegate on Solana and Genesis launched a pool in early June. Meanwhile, on Ethereum, there are multiple pool delegates including Orthogonal Trading and Maven11.

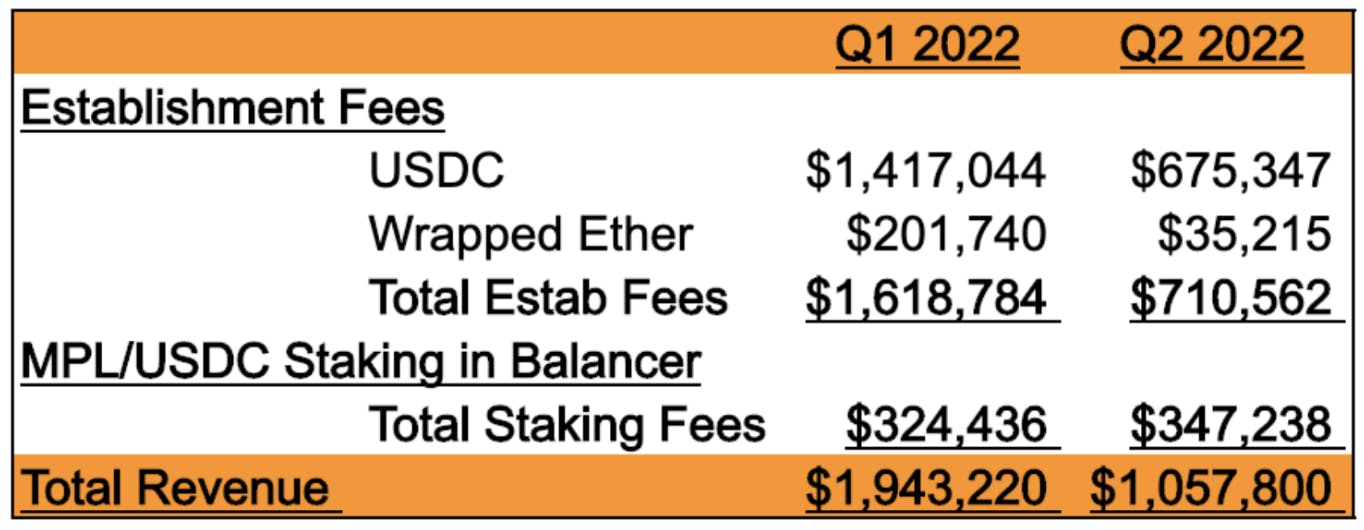

Delegates earn income in two ways: loan establishment fees and ongoing (or staking) fees. The one-time establishment fee (0.99% annualized) is paid for the due diligence and preparation of the loan. It is split between the pool delegate (~33%) and Maple Treasury (~66%) and is a portion of the loan that is deducted from the funds given to the borrower. The ongoing fee is a percent of the interest received that is shared between the pool delegate and cover providers. This is to compensate for both the management of the pool and the higher risk assumed compared to lenders.

Lenders

Prospective lenders on Maple must first choose a pool based on personal risk tolerance, APY, and whether a pool is public or private (private pools are reserved for institutional lenders). They can then deposit the denominated cryptocurrency (all current pools use either USDC or wETH) into the desired pool. This deposit will be locked up for a 90-day period and the pool delegate then allocates the funds into loans for the institutional borrowers.

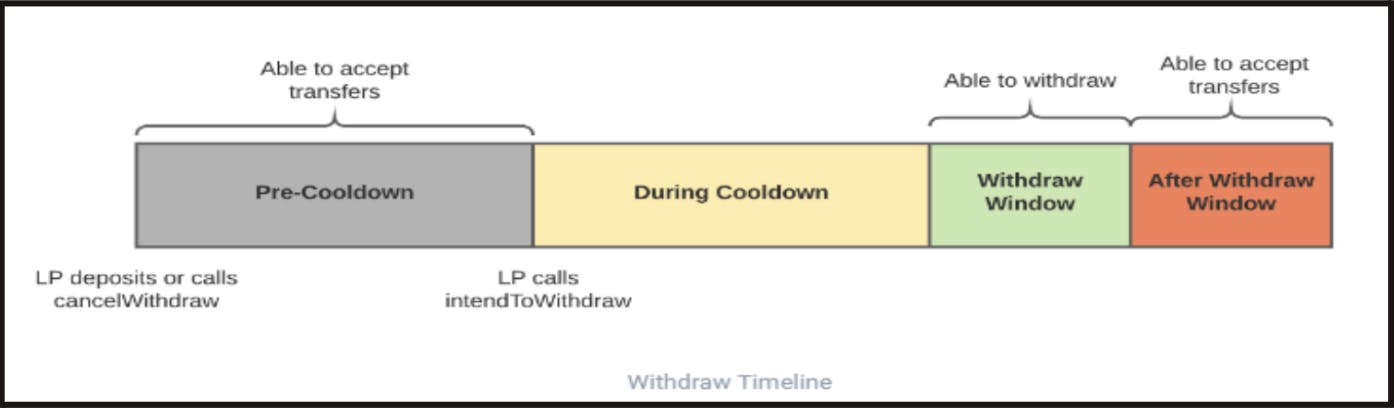

In exchange, lenders receive Maple Pool Tokens (MPTs) representing their share of the pool. The interest they accrue is reinvested by the pool and therefore compounds until claimed. While earned interest can be claimed at any time, the principal (which the lender exchanges their MPTs for) is subject to the lockup period and a subsequent 10-day cooldown period once withdrawal is initiated. After both periods have passed, lenders have a 48-hour window to actually withdraw their position. Missing this 48-hour window requires another 10-day cooldown period. In addition, during this 48 hour period, everyone is given equal preference to withdraw. This in effect creates a clicking race to withdraw capital. This problem has created a lot of friction with lenders and will likely be addressed in Maple 2.0, Maple’s second version. It should also be noted that as of August 1, 2022, MPL Rewards are no longer accrued during the cooldown period and withdrawal window.

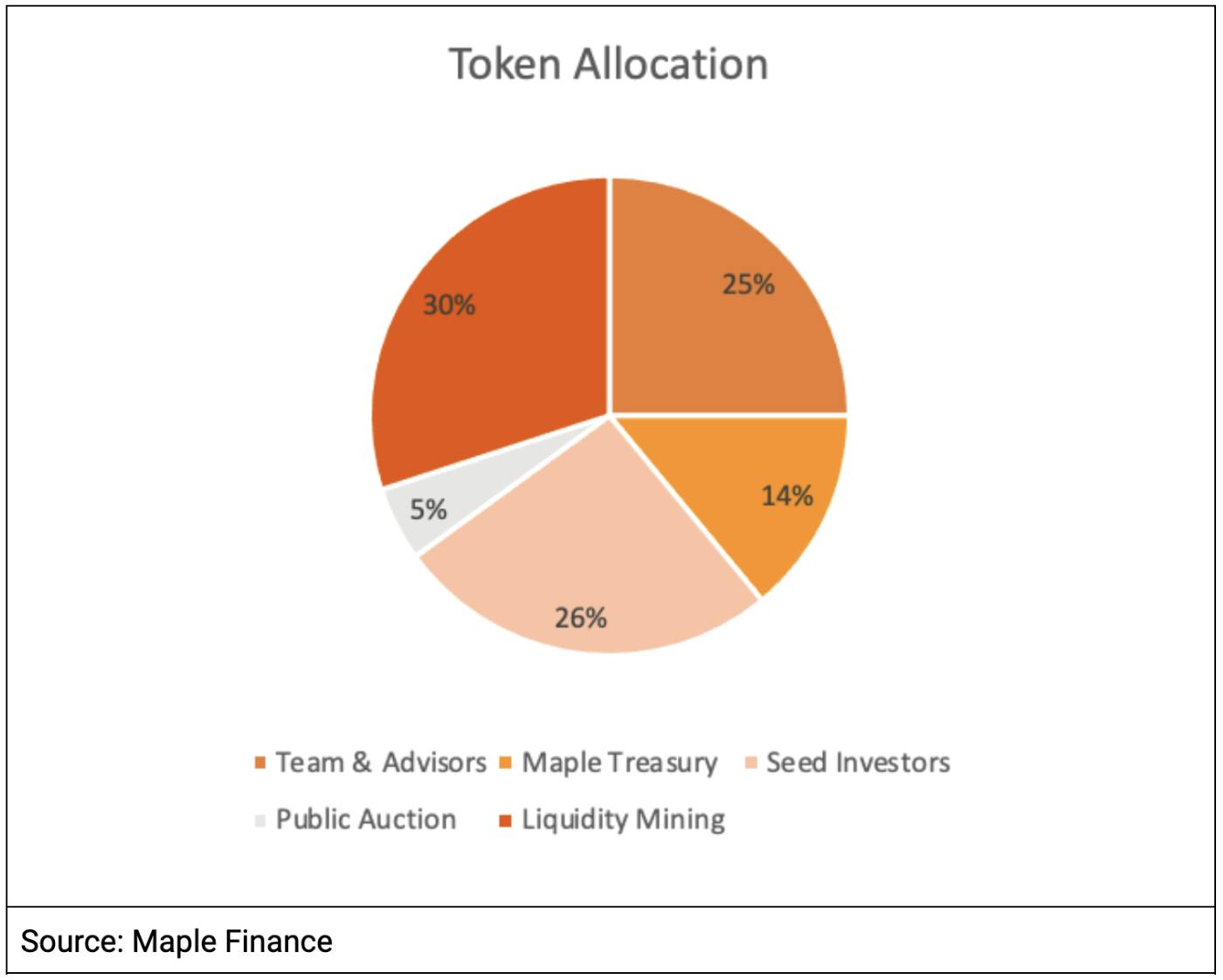

In public pools, the interest earned from borrowers is a portion of the total APY, a rate pre-determined based on market conditions. The remaining portion of the total APY is made up of MPL Rewards, which come from the token allocation designated for Liquidity Mining (30% of overall allocation, full chart in Tokenomics & Value Accrual section). However, there are no MPL Rewards in private pools. See the APY Calculation subsection to see how the interest rate and MPL Rewards rate are determined.

Cover Providers

MPL token holders can deposit their MPL and USDC into a MPL-to-USDC 50:50 ratio Balancer pool to receive Balancer Pool Tokens (BPTs). They can then provide pool cover with their BPTs in particular pools to give insurance to that pool. That means that if a borrower defaults, the BPT will be the first to be liquidated. In return, providers receive one-tenth of the pool’s interest yield (pools with less pool cover will have higher APYs). For example, if this average yield is 10%, then the cover reserve receives 1% (0.1*10%) as fees.

However, this system will be replaced. Maple recently announced they will be moving to a single-sided pool cover with the removal of the Balancer Protocol. This will prevent impermanent loss as well as the issues arising from reliance on Balancer. One of these issues is the maximum amount of collateral that can be withdrawn from Balancer. Currently, only ⅓ of the current USDC supply on Balancer can be swapped out. In the event of a borrower default, this means, at maximum, only ⅙ (⅓ * ½ USDC) of the cover can be used to provide as cover. See the Announced Tokenomics Improvements section for more on Maple’s solutions.

Borrowers

Institutional Borrowers leverage their financial history and undergo an off-chain KYC-AML due diligence process in order to become eligible to borrow on Maple. The rate of collateralization is negotiated between the borrower and pool delegate. Borrowers must borrow a minimum of $1 million.

If borrowers don’t make their payment, they have a 5-day grace period to make the payment or inform the pool delegate of their cash flow holdup. After the grace period, if the borrower still hasn’t paid, the pool delegate can liquidate the collateral and place it into the lending pool. Because the loan is on-chain, if the borrower defaults, this will be open for everyone to see forever, which in turn will significantly hurt the reputations of both the borrower and pool delegate.

Tokenomics & Value Accrual

MPL tokens were first issued to private investors, which last occurred in March 2021 and resulted in a fully diluted valuation of $50M ($5/token). On April 28 2021, a 72-hour fair launch was conducted for the general public (Public Auction), in which Maple used the Balancer Liquidity Bootstrapping Pool (LBP) method to distribute 500,000 (5% of total supply) tokens to over 1,000 token holders and raised 10 million USDC. This approach was chosen as it creates constant sell pressure over a fixed period of time while lowering prices when there is no demand.

Seed (sale round) investors have a 1.5-year vesting schedule while team members have a 2-year schedule.

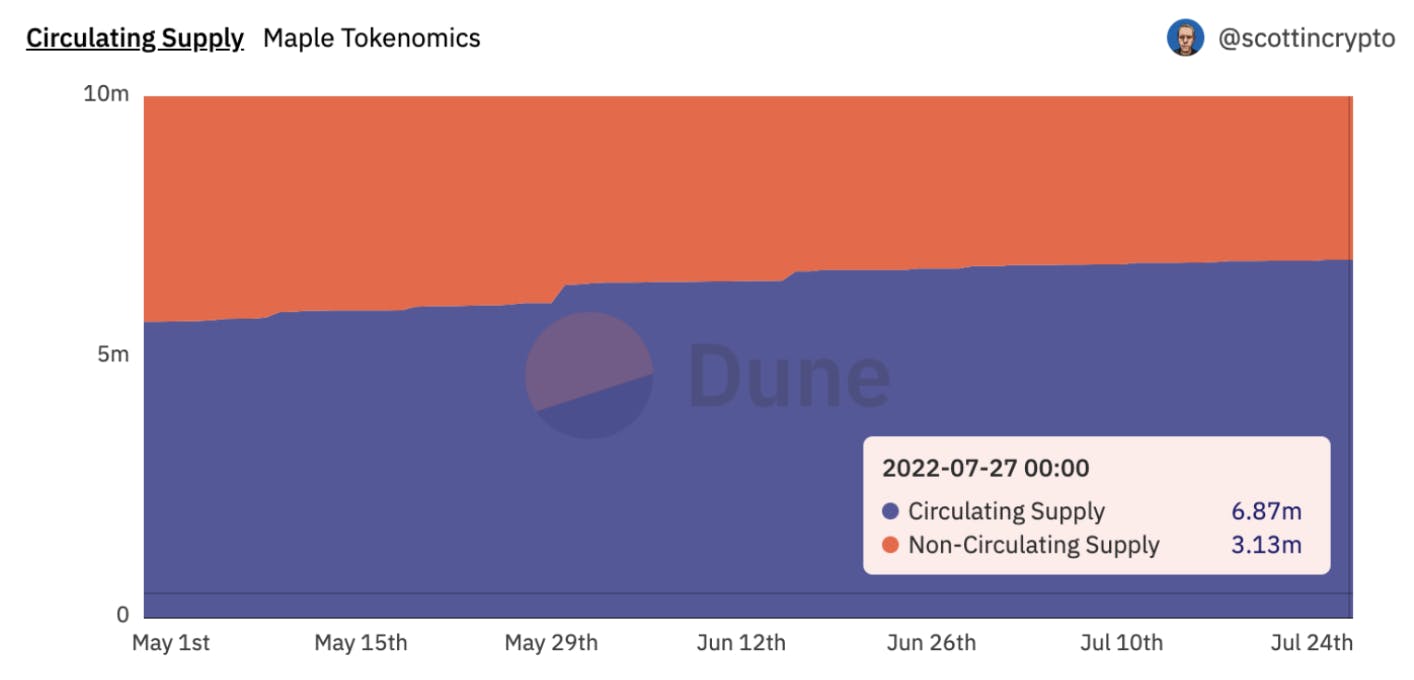

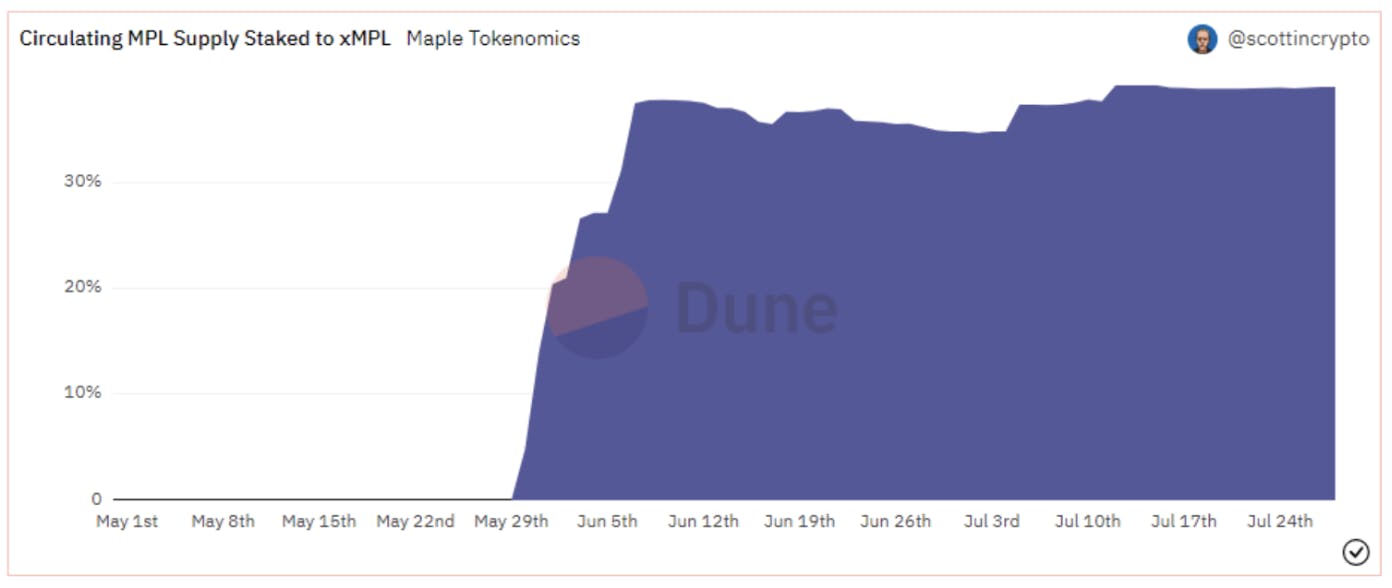

The maximum (fixed) supply is 10 million MPL tokens, of which ~69% is already circulating. Users can obtain MPL tokens by earning rewards from lending to pools or staking their MPL tokens to receive xMPL. Over 39% of MPL circulating supply has been staked to xMPL since May 30 2022 (xMPL launch date). See the Governance, MPL Token & xMPL subsection for more on xMPL.

Governance, MPL Token & xMPL

The MPL token is an ERC-20 governance token that also utilizes the ERC-2222 token standard to add functionality for profit distribution from the Maple Treasury. As of the time of writing, Maple has held 8 community votes – called Maple Improvement Proposals (MIPs) – with voting conducted on a private Discord channel. MIPs are posted on both Discord and the community page on Maple’s website. Votes must have a 20% quorum or voting time is extended.

Currently, there are three main uses for MPL holders.

1) Token holders can earn fees

2) Voting on MIPs. Eligible voters – those who hold or stake at least 25 MPL (or xMPL) tokens and register on Discord & collab.land – are called Mapes. Mapes have the ability to vote on MIPs which can include adjusting fees, minting/ burning MPL tokens, adding new currencies, and more. They can also vote on how to use the accumulated treasury revenue (revenue accrues from the 66% of the establishment fee paid by borrowers for diligence). For the most part, they have three options:

- buyback MPL to distribute to xMPL holders

- buyback MPL to hold in Maple Treasury

- distribute the fees to MapleDAO to fund operations and growth

By delegating their voting rights, Mapes can also passively express their governance.

3) MPL tokenholders can stake their MPL into a Maple-owned smart contract to receive xMPL. Holders of xMPL not only retain governance rights but also are able to share in treasury revenues. A portion of monthly treasury revenues (currently 50% by MIP-08 but subject to change by the DAO), will be used to buy back MPL from the open market. Ultimately, the bought-back MPL will then be evenly distributed to xMPL holders. Before Q2 2022, MPL holders would have to deposit their tokens with USDC into a Balancer Pool and stake BPT as first-loss capital for higher returns. Additionally, xMPL will always be worth more than 1 MPL. As Maple revenue increases and more MPL is paid out to xMPL holders, xMPL will accordingly be worth more and the exchange rate between MPL and xMPL will diverge.

Announced Tokenomics Improvements

Maple is in the process of updating their tokenomic framework in the following ways, and has set out some targets for the second half of 2022 in their recently released roadmap.

Firstly, pool cover is set to be overhauled. Maple will replace 50:50 MPL-to-USDC Balancer Pool mode with a single-sided pool cover denominated in USDC to remove impermanent loss. This reduces the wrong-way risk of using MPL as first-loss collateral, where defaults could lead to a falling MPL price that subsequently lowers the value of the cover.

Secondly, similar in form to a rebate, Maple may offer borrowers who hold xMPL better terms including reduced borrowing costs. The idea is that this would result in increased borrower retention and loans issued on the protocol.

Revenue, TVL, and Key Metrics

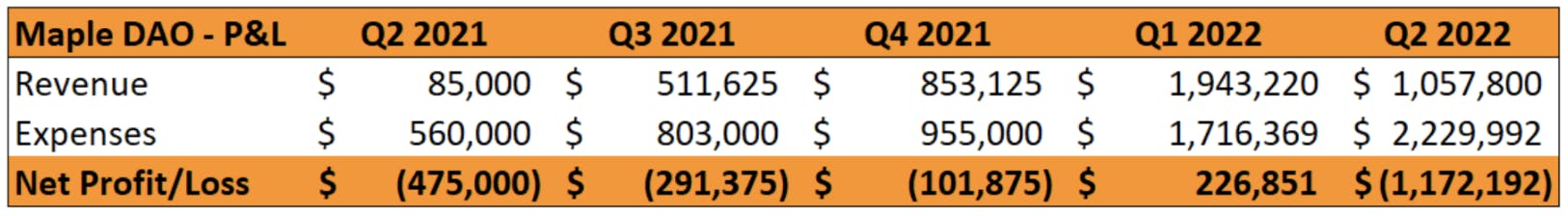

From Q2 2021 to Q2 2022 the Maple DAO Treasury has incurred steady and increasing revenue from the portions of establishment fees collected. However, due to the 2022 crypto bear market, Maple DAO experienced a contraction in revenue. Because Maple DAO’s revenue is entirely dependent on the new loans being issued, this could be indicative of slower short-term growth. However, the overall number of lenders increased by 25% throughout the quarter thereby demonstrating Maple’s strong reputation; lenders feel confident in entrusting delegates with their capital to fund well-capitalized enterprises with strong cash flows. Furthermore, the only ever default on Maple was a $10 million loan issued to Babel Finance.

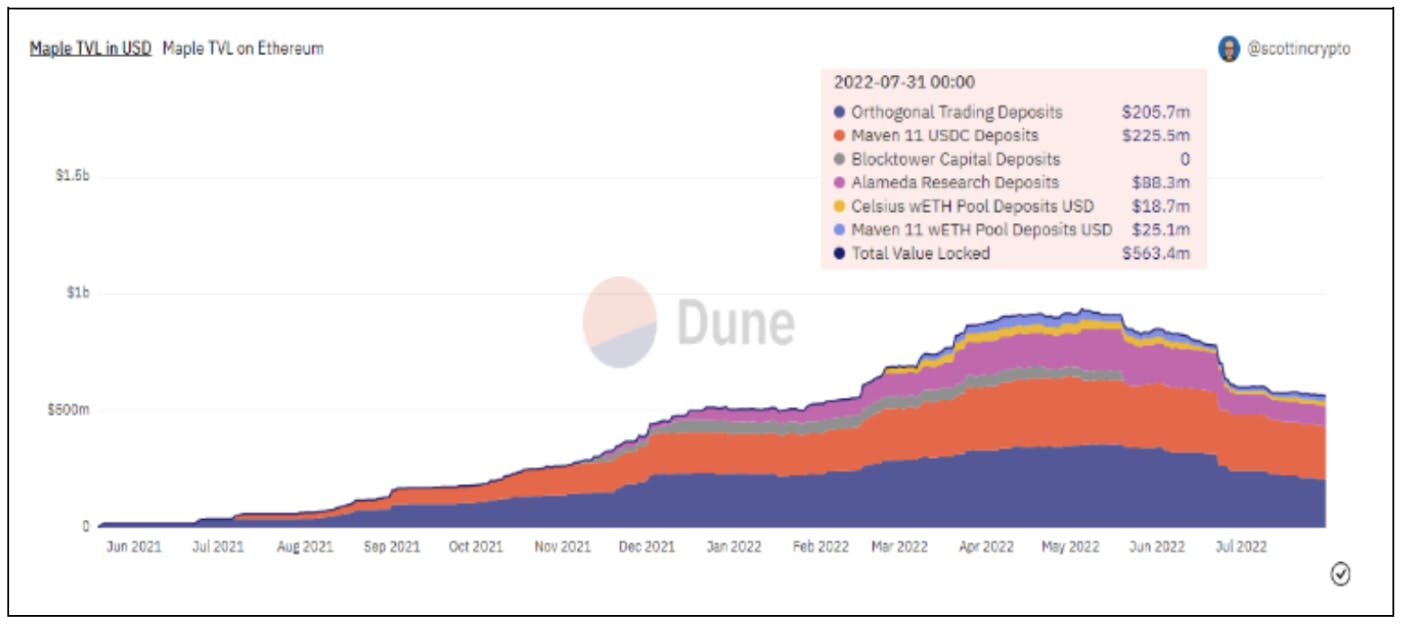

In addition, when compared to the rest of the industry, Maple is holding its ground in this liquidity contraction. According to their Q2 treasury report, while the industry’s Total Value Locked (TVL, meaning the value of deposits on the platform) shrank 67%, Maple’s TVL only shrank 12% between Q1 2022 to Q2 2022. Prior to 2022, Maple’s TVL was steadily growing over time. 23% of lenders have expanded their lending position since Maple's start by an average of 3.76 times their initial investment. Below is a breakdown of Maple’s TVL by pool on Ethereum since inception.

Another metric to consider is a protocol’s utilization ratio (UR). It’s calculated as the Total Loans Outstanding (TLO) divided by the TVL. Generally, a high UR has indicated that a protocol is sustainable as it is able to maximize interest generation by lending out the majority if not all the capital injected into its pool(s). However, in this bear market, many lenders are withdrawing their funds and reducing the amount of cash in the pools. This is pushing up the UR and giving the illusion of pools becoming more efficient when in reality, they are not. However, prior to the bear market, Maple’s pools consistently had some of the highest utilization rates (>95%) among its competitors showing its efficiency. Today, like its competitors, many of Maple’s pools have utilization rates of 100% because lenders have withdrawn all of the available cash.

APY Calculation

As discussed earlier, the total Annual Percentage Yield (APY) in public pools comes from the borrower’s interest payments and MPL Rewards, which are paid out from the liquidity mining token allocation. The interest rate paid out by the borrower is determined by the pool delegate who underwrites the loan and negotiates the terms. APY from MPL rewards varies based on three main factors: the average MPL price over the previous 7 days, target pool cover volume in the protocol for the next month, and the target total APY (borrowers payments + MPL rewards) for that month (based on market conditions).

The reserve size for each pool’s cover is targeted at ~8-12% of a pool’s loan balance, while the target total APY is around 15-20%, based on current market conditions for stablecoin farming. If the 8-12% cover target is met, then MPL rewards will be given out to help subsidize the total APY to the target total APY of 15-20%. However, as cover decreases, the MPL Rewards decrease and as such the total APY decreases. This is evidenced as most pools on Mape have a 1-3% cover reserve and accordingly, total APYs are within the 6-10% range for public pools, way below the target total APY of 15-20%.

Market Overview & Competitors

TrueFi, which launched in late November 2020, was one of the first undercollateralized lending platforms on Ethereum and is now also on Optimism. Originally, lenders deposited their stablecoins into pools managed by TrueTrading. Borrowers had to go through a credit review coordinated by TrueFi and be approved by TRU stakers. But as of January 2022, TrueFi is rolling out its Marketplace. Similar to Maple, this allows third parties to create and manage their own lending pools. While TrueFi has certainly been in the game the longest, as shown with the highest Total Loans Originated of over 1.65B compared to Maple’s 1.53B, its TVL, Active Loan Value, and Cumulative Protocol Revenue are still dwarfed by Maple.

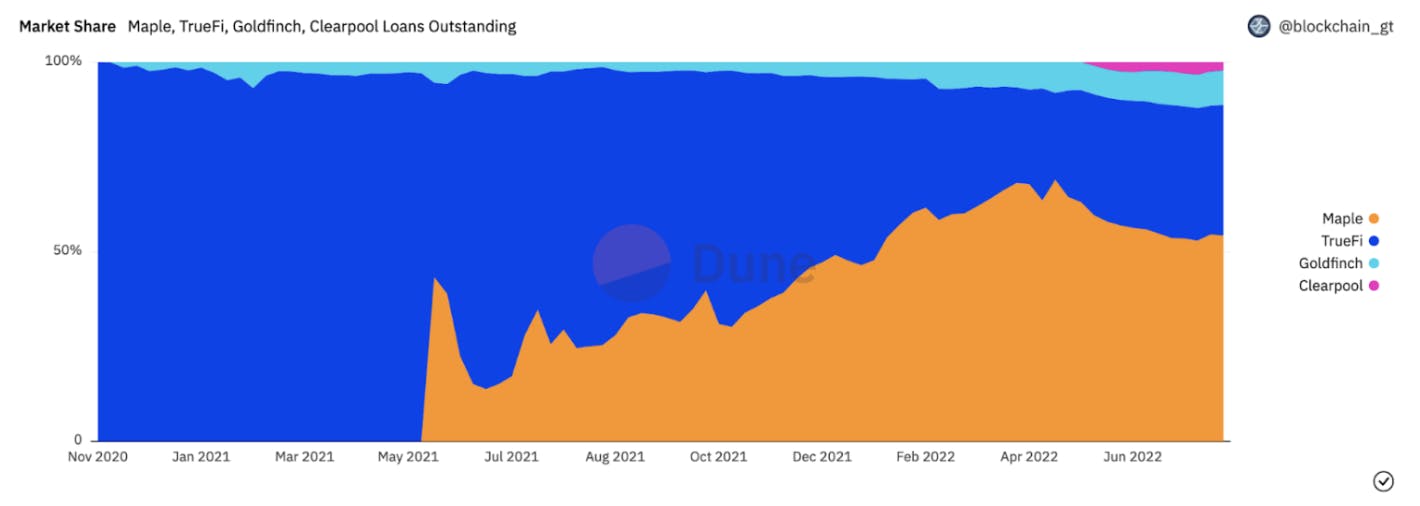

Launched a year and two months ago, Maple was the first to build a platform allowing professional pool delegates to evaluate borrowers. Being the first at cracking this superior model has allowed it to skyrocket in growth and build customer loyalty early on. As a result, TrueFi’s market share in terms of Active Loan Value has steadily declined from 100% to as low as 22.9% back in late April 2022. However, TrueFi is planning to expand its borrowing opportunities by onboarding real world assets on-chain for collateralization. This has the potential to help TrueFi regain its market share, but the regulatory uncertainty makes it a very risky move.

Goldfinch (launched Dec 2020) and Clearpool (launched Oct 2021) are also both important players in the undercollateralized market. Goldfinch is an Ethereum-based protocol focused on expanding credit access with a similar model to TrueFi of “trust through consensus”, while Clearpool (on Ethereum and Polygon) differentiates itself by offering variable rates. Being that the variable interest rates for undercollateralized loans have very little competition currently, Clearpool could do very well to prevail in this subspace. Even though both have quite low TVL and Active Loan Value currently, they have both experienced continuous growth in their market share.

While Maple’s protocol design led it to overtake TrueFi’s market share in late December 2021 and reach a peak of 69% in late April 2022, it has had a slump in market share recently because of lenders’ fears over macro market conditions. In the long term, Maple must continue to innovate and bring utility to its platform and token if it wants to stay ahead. They plan to fuel growth by making strategic moves to strengthen their grip on the institutional space. While its biggest borrowers have been market markers such as Alameda Research, Maple CEO Sidney Powell wants to expand beyond them, with bitcoin mining institutions likely being Maple’s next target. This is furthered by his vision of eventually onboarding Fintech, SaaS, and other non-crypto vertical companies as borrowers.

H2 2022 Roadmap

Maple has recently released their roadmap for the second half of 2022, announcing Maple 2.0 and broader plans for Solana. Maple 2.0 mainly entails an upgrade to the smart contract infrastructure that will allow for more agile developments alongside functional enhancements aiming to attract more lenders.

One such enhancement is switching how interest payments get distributed. Previously, interest was distributed the same regardless of when in the month lenders deposited. For example, a lender who deposited USDC on the first day of the month received the same interest as someone who deposited at the month’s end – the day the interest payment is made. This is being amended to work similar to Compound’s cTokens: when someone deposits an asset on Compound, they mint cTokens which can be exchanged back for the collateral in the pool. To accrue interest, “each cToken becomes convertible into an increasing amount of its underlying asset, even while the number of cTokens in your wallet stays the same.” Maple 2.0 will use a similar model where lenders and cover providers can receive pool tokens for depositing the denominated assets (currently USDC or wETH) that become exchangeable for more of the deposited asset. Therefore, this means those who provide liquidity for longer are rewarded more, and also that compounded interest will essentially be applied automatically. Also, these pool tokens will be able to be traded on secondary markets.

Another announced enhancement is that pool delegates will be given more flexibility to operate their pools. One example of this is pool delegates offering lenders shorter-term lockup periods for loans in the near future.

Solana

In early January 2022, Maple acquired Avari to facilitate quicker expansion onto the Solana blockchain and retained three Avari employees including Quinn Barry (co-founder & CEO), who became head of Maple’s Solana division. On April 25th, Maple launched on Solana, becoming the first protocol to offer undercollateralized lending on Solana. The first pool, with X-Margin as pool delegate, raised $40M from Circle, Coinshares, and Solana natives, and immediately issued loans worth $42B to Alameda Research, Framework, and Nascent. There are plans to grow this pool to $300M by the end of 2022. And on June 1st, it was announced that Genesis Trading would be opening the second Solana pool, from which both Wintermute and Amber Group have collectively borrowed $75 million as of the time of writing.

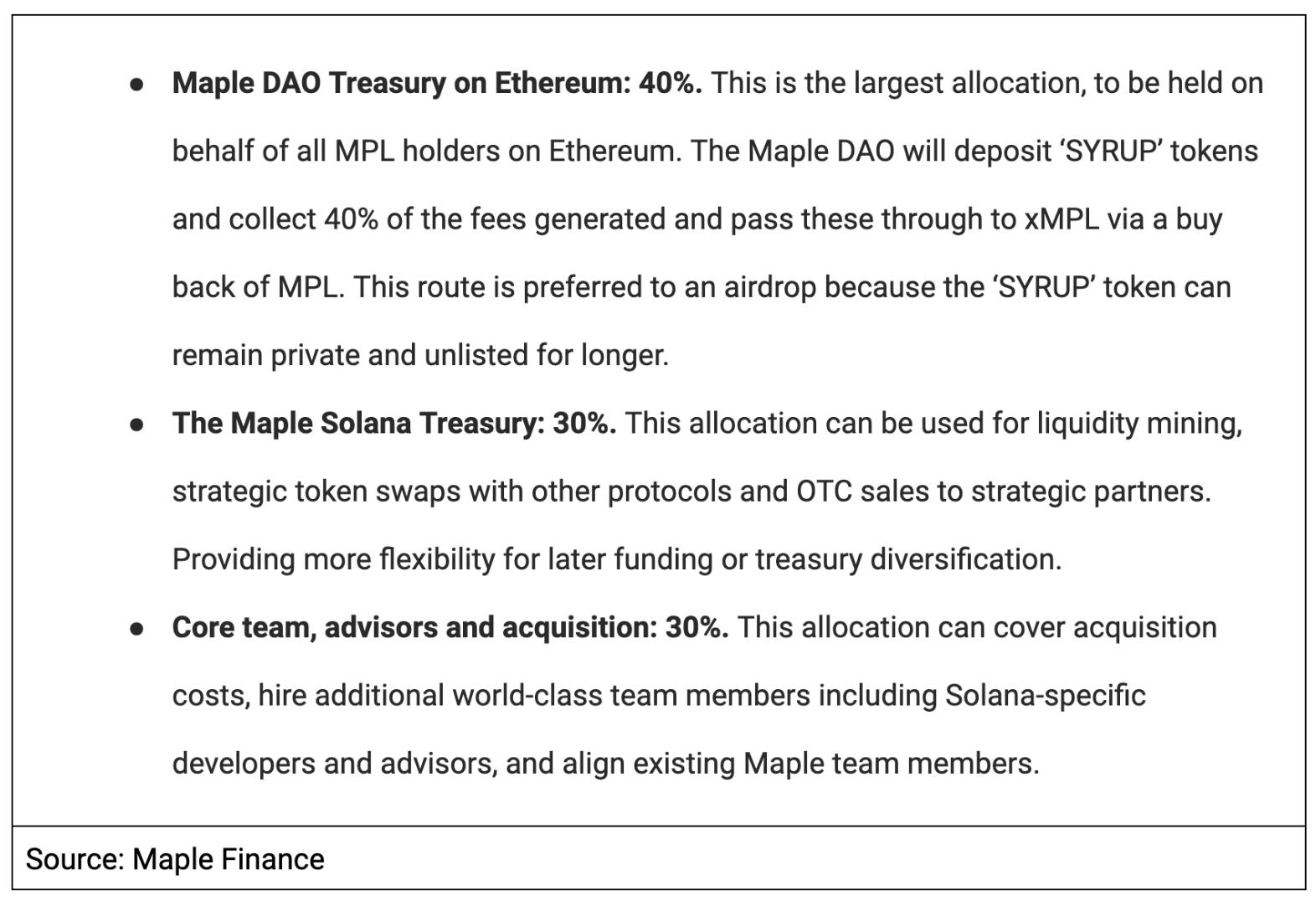

Overall, Maple hopes to issue $1B in loans on Solana by the end of 2022 and also launch a separate token on Solana to be called SYRUP during the second half of 2022. Maple is adamant that this is more desirable than bridging given issues with security and capital efficiency. For example, bridging the MPL ERC-20 token to Solana would dilute it when liquidity mining. This approach also allows for more flexibility in the future, when hopefully bridging technologies improve, and permit the ‘reunification’ of SYRUP with MPL and also the expansion of Maple into other EVM-compatible blockchains. Ultimately, Maple Treasury would become the largest holder of SYRUP utilizing the following tokenomic vision:

Timeline of Events

To recap, a timeline of Maple’s progress has been included below for your convenience.

Risks

As always, there is counterparty risk that must be considered when lending assets. Though Maple itself is not exposed to defaults as it is only the infrastructure to bring loans on-chain, defaults can still harm Maple’s reputation and make lenders wary about depositing. While the pool cover is supposed to protect lenders, most pools have between a 1-3% principal loan cover, which is way below the 8-12% target. This was experienced with the Babel default of $10 million in Orthoganal’s pool. Because of the low collateralization rate and one-third Balancer issue, only $1.28 million (one-sixth) of the $7.75 million of deposited cover went towards actually covering the $10 million default. This left lenders to take on the rest, $7.8 million of the default. However, Maple DAO has done a great job at selecting excellent delegates as they’ve only ever had this 1 default.

In addition, there are concerns surrounding the sustainability of MPL rewards, which are used to help bring the total rate up to the market yield and are currently being subsidized by Maple to attract liquidity. Lending rewards are unsustainable because they come from a fixed, decreasing allocation (the Liquidity Mining) of tokens. If however, Maple is able to continue growing through increased institutional adoption and trust, this risk is mitigated by the time the rewards allocation runs out.

Conclusion

Decentralized capital markets are an exciting space that continues to experience substantial evolution and innovation. Maple, with its focus on and success with institutional borrowers, has established itself as the clear leader in the undercollateralized subsector. Even with new entrants and strong existing competition – mainly Goldfinch, TrueFi, and Clearpool – Maple has become the dominant player in the market by continually improving its product and adding talent to its team. This is reinforced by their pole position in terms of TVL, loans, and treasury revenue.

In terms of strategy against its competitors, Maple has decided to take a bold move of sticking solely to the institutional space, reaffirming their conviction in it as a sustainable source of yield. It also spares them the regulatory uncertainty surrounding the onboarding of real world assets as collateral that competitors such as TrueFi have decided to tackle head-on. While on-chain real-world assets will certainly be a huge market that Maple could be missing out on, we see the institutional lending space as a sizable opportunity and one that presents much less risk going forward.

This recent downturn has revealed a few design challenges within the Maple protocol, including issues with how cover is provided via the balancer pool, how withdrawals are structured, and how interest payments are distributed. However, Maple has proven to be incredibly resilient over this time period and Maple 2.0 not only displayed its willingness to listen to criticism but addresses many of the mentioned issues. They’ve also been highly transparent about the state of each pool during a time of immense uncertainty. Overall this is a cause for optimism and we foresee Maple 2.0 as staying one of the stronger, if not the dominant player, in the institutional credit space going forwards.

Blockchain @ Georgia Tech Socials

If you enjoyed this deep dive stay up to date with Blockchain at Georgia Tech’s upcoming events and posts by following us on Twitter and LinkedIn!

Wallet Addresses

MPL Token (Ethereum): 0x33349B282065b0284d756F0577FB39c158F935e6

xMPL: 0x4937A209D4cDbD3ecD48857277cfd4dA4D82914c

Maple Treasury (collects fee revenue for the protocol): 0xa9466EaBd096449d650D5AEB0dD3dA6F52FD0B19

Maple DAO (holds balance sheet and governor of protocol): 0xd6d4Bcde6c816F17889f1Dd3000aF0261B03a196

Maple Labs (receives grants and pays expenses): 0x94F98416CA0DC0310Bcaeda0e16903e19307539F

Balancer Pool: https://pools.balancer.exchange/#/pool/0xc1b10e536cd611acff7a7c32a9e29ce6a02ef6ef/swaps

Additional Resources

https://dune.com/scottincrypto/Maple-Deposits

https://dune.com/blockchain_gt

https://tokenterminal.substack.com/p/weekly-fundamentals-134

https://polygontech.medium.com/the-crypto-loan-economy-d788ac794b3c

https://www.gemini.com/cryptopedia/maple-finance-crypto-mpl-token-maple-token-mpl-crypto

https://twitter.com/i/spaces/1MnGnkkOBMBJO?s=20

Sources

https://www.maple.finance/ | https://maplefinance.gitbook.io/maple | https://community.maple.finance/ | https://app.maple.finance/#/xmpl | https://github.com/maple-labs/maple-core/wiki

https://maple.finance/news/maple-roadmap/ | https://www.maple.finance/news/q2-2022-treasury-report/ | https://www.maple.finance/news/share-in-maples-growth-with-upcoming-changes-to-tokenomics/

https://dune.com/scottincrypto/Maple-Deposits

https://messari.io/asset/maple-finance | https://tokenterminal.com/terminal/projects/maple-finance | https://coinmarketcap.com/currencies/maple/

https://twitter.com/maplefinance | https://maplefinance.medium.com/

https://cointelegraph.com/news/crypto-lender-maple-finance-expands-support-to-solana

https://quinnthompson.substack.com/p/maple-finance-research-report-from

https://twitter.com/syrupsid/status/1550100024943583233

https://twitter.com/HassanBassiri/status/1547293957926686723?s=20&t=5gY7cCtWfpCtOJ08jLSk4A

https://compound.finance/docs/ctokens#introduction

https://docs.goldfinch.finance/goldfinch/ | https://clearpool.finance/ | https://truefi.io/

https://dune.com/0xbageltoes/goldfinch-protocol | https://dune.com/tt_tyler/tru-staking-burns | https://dune.com/davy42/clearpool | https://app.clearpool.finance/lend